Financial Investment Advisors

Private assets will continue to grow as they respond better to the needs of the economy by allowing to invest in high growth companies who do not have access to public markets.

While the investments in the local economy is a very important matter for us, we are convinced that it is wise to take benefit from a global approach when investing.

Portfolio construction and fund selection is even more essential on the unlisted assets because the differences of returns are much more important between the good and the poor funds than in listed markets.

In Europe, the share of unlisted assets in the allocations of the institutional and private investors is lagging versus the US and China. We expect a strong growth of those assets. But the access of the most talented managers remain complex/

Kermony Capital aims to participate to the fluidisation of this market and facilitate the access to the best talents for the mid-size institutions and the wealth managers.

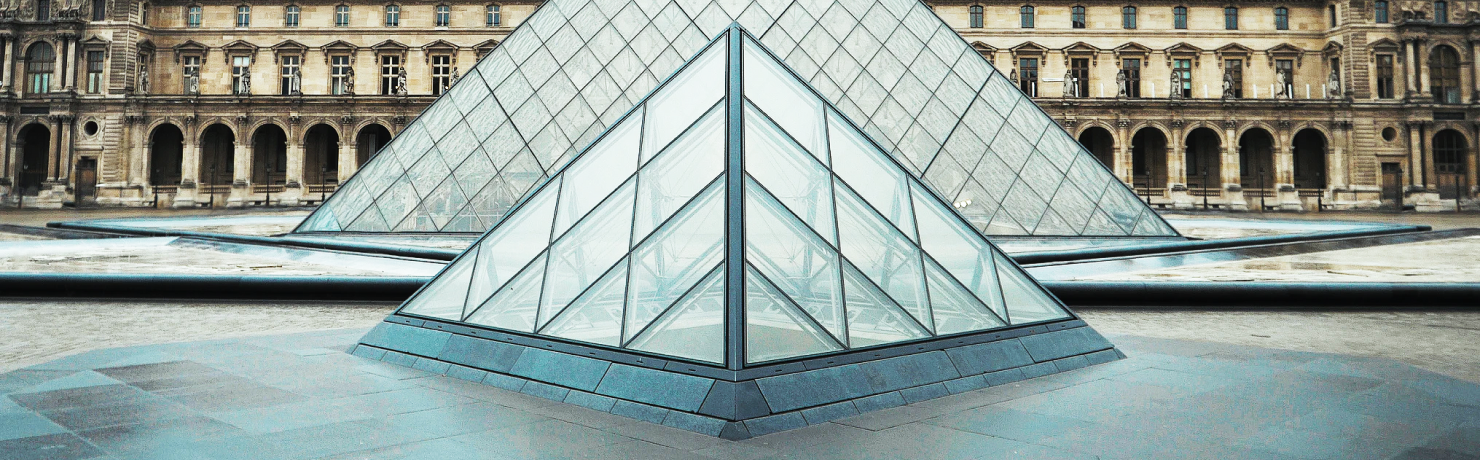

Kermony Capital is an Investment Advisor (Conseiller en Investissements Financiers CIF) established since december 2019 and based in Paris. The company partners with French and International experienced managers to set up investment solutions on private assets for qualified, professional and institutional investors.

Kermony Capital covers through those solutions multiple asset classes and segments in the private and alternative area such as ; private equity, private debt, infrastructure, renewables,…

Taking advantage of a +20 years of experience in global asset management of its founder, Kermony Capital relies on a strong expertise in the understanding of the specific requirements of clients (regulatory, aspirations,…), the set up of customized solutions (mandates, white label fund, fund of funds,…) and the sales support. Kermony Capital takes benefit from its wide network of relationships of experts for the structuration and the set up of appropriate solutions which respond to the market constraints.

Our services

Because the dispersion of performance between the good and the less good managers is much wider on unlisted than listed assets, accessing the best skills in the unlisted is essential. Making the link between these experts and investors to offer diversified, robust and efficient portfolios is our objective.

Our partners

Experienced partners trust us to participate in the deployment of their solutions to institutional and professional investors.

Pantheon Ventures

Founded in London in 1982, Pantheon has more than 35+ years of experience in investing in private assets. Pantheon has developped a strong track record of with more than 2 000 funds investing, 450 seats in advisory committees which allow to get access to proprietary deals very difficult to access. Pantheon...

Entrepreneur Invest

Founded in 2000 by some successful entrepreneurs, Entrepreneur Invest aims to provide its network and experience to other entrepreneurs and helps in financing the growth of small and mid cap firms. Today, Entrepreneur Invest is positioning itself as one of the leaders in private equity investments with ...